Using EMA and vfxAlert for Better Trading Analysis

EMA, or Exponential Moving Average, is a valuable indicator for traders and analysts as it provides insights into the average price of an asset over a specific time frame. What sets EMA apart from the Simple Moving Average (SMA) is its unique feature of assigning varying weights to individual data points. This means that recent data points carry more significance than older ones.

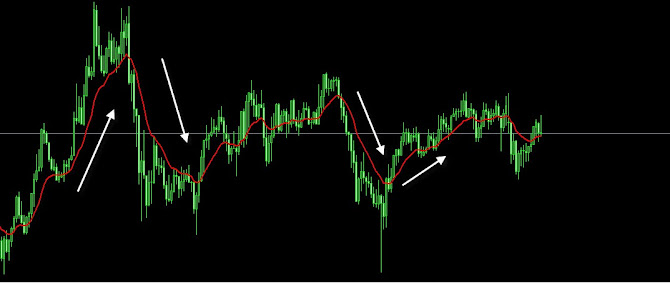

For more reliable analysis, it is advisable to use EMA alongside vfxAlert. EMA can occasionally generate false signals, especially in markets characterized by sideways movement.

vfxAlert live binary signals is a comprehensive set of trading tools designed for market analysis on various broker platforms. Regardless of your chosen broker, vfxAlert allows you to swiftly assess market dynamics. To see vfxAlert in action, you can click here.

Markets can often be noisy, with prices oscillating around the EMA without a clear trend. During such times, vfxAlert can provide additional insights into the market's status. For example, it can gauge the strength of price movements, while the RSI displayed on vfxAlert dashboards can help identify overbought or oversold conditions.

Here's a guide on how to effectively use these tools:

- When the asset's price is above the EMA, it may suggest an uptrend. Exercise patience and wait for vfxAlert to confirm the signal before considering a Call option.

- Conversely, when the asset's price falls below the EMA, it may indicate a downtrend. Wait for vfxAlert's confirmation signal before considering a Put option.

Combining vfxAlert with EMA enhances the accuracy of your market analysis. When multiple tools align to confirm a signal, it provides greater confidence in your trading decisions.

To access vfxAlert signals, you can download them here.

Комментарии

Отправить комментарий